Recessions don’t happen overnight. They creep in slowly, often disguised as ordinary changes in spending, hiring, or business behavior. While official declarations come late, the signs are almost always there—quiet shifts that signal something bigger is brewing. From fewer restaurant meals to rising credit card debt, these early warnings reflect how people and businesses brace for impact. Recognizing these subtle shifts can help you stay ahead of the curve, prepare financially, and understand what’s really happening in the economy. Here are ten early clues that often hint a recession may be on the horizon.

1. People Start Cutting Back on Dining Out

When economic clouds begin to gather, one of the first lifestyle shifts is how people eat. Dining out—whether at fine restaurants or fast-food joints—is one of the easiest expenses to cut. Families start meal planning, bringing lunch to work, and avoiding takeout altogether. Even coffee shop visits might drop. Restaurant sales, particularly in casual dining chains, tend to reflect this trend early. If multiple eateries start offering aggressive promotions, slashing hours, or closing locations, it’s often because foot traffic is down. That slowdown in spending hints that people are preparing for leaner times, even if the official recession hasn’t been declared yet.

2. Temporary Jobs Disappear First

One of the earliest warning signs of an economic slowdown is the shrinking of temporary and contract-based employment. These roles are often the most vulnerable in uncertain times, as companies use them to adjust workforce size without permanent cuts. When businesses sense a slowdown, they cancel temp contracts and halt freelance work. This change often flies under the radar because full-time jobs remain steady—at first. But rising layoffs in staffing agencies or reduced job postings for short-term gigs often foreshadow broader employment troubles. Economists track these changes closely because they predict deeper cuts down the road.

3. Used Car Prices Take a Hit

Used cars are one of the most revealing economic indicators. When people feel financially secure, they’re more willing to upgrade their vehicles or purchase secondhand cars. But when insecurity sets in, car buying is one of the first areas where spending slows. Falling used car prices reflect weaker demand, especially if paired with rising loan interest rates or tighter credit approval standards. This can lead to a surplus in inventory, dealership discounts, and even repossessions. A sustained decline in used car values typically signals that consumers are pulling back on major purchases—an early hint of recessionary behavior.

Read More: 7 Smart Reasons to Delay Buying a Home During Tariff Turmoil

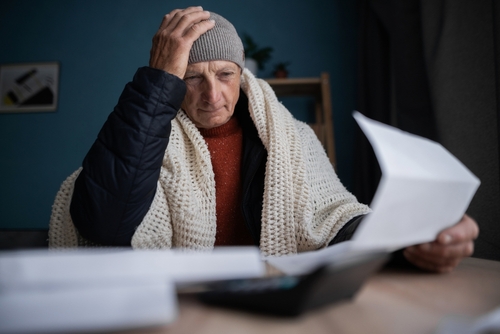

4. Credit Card Debt Starts to Spike

Credit card usage offers a real-time look into household financial health. When balances rise quickly—and delinquencies start to follow—it often means consumers are using credit to maintain their lifestyles or cover essential costs like groceries and utilities. If debt is rising while wages stay flat or shrink, it indicates financial strain. Missed payments also suggest that people are falling behind. This pattern tends to grow quietly before making headlines. Once the default rates start creeping up, it usually spells bigger trouble ahead for both individuals and the wider economy.

5. Luxury Sales Begin to Drop

Luxury markets are incredibly sensitive to economic shifts. High-income consumers are often the first to react to changing financial winds—not because they can’t afford items, but because they’re more attuned to investment conditions and market signals. When luxury brands see declining foot traffic, empty showrooms, or fewer online orders, it often reflects broader unease. Even subtle reductions in spending by the wealthy can ripple across industries like fashion, travel, and real estate. These early pullbacks in premium purchases have historically been some of the first signs of economic contraction.

6. Freight Shipments Quietly Decline

Goods don’t just magically appear on store shelves—they move through a complex network of freight and logistics. A slowdown in this network often means production is down, sales are weakening, or demand is drying up. Trucking companies, railways, and cargo firms often feel the pinch months before consumers notice. Fewer shipments typically mean retailers and manufacturers are anticipating lower demand. If warehouses are staying full and fewer goods are moving, businesses might already be scaling back. It’s a silent, behind-the-scenes signal that the gears of the economy are slowing down.

7. Layoffs in the Tech Sector

Tech companies are often on the frontlines of economic optimism—and pessimism. They hire aggressively in good times and slash headcounts just as fast when uncertainty creeps in. Since many tech companies rely on venture capital or forecasted profits, they respond swiftly to negative market outlooks. Layoffs in Silicon Valley or other tech hubs frequently make the news. But even before mass layoffs, hiring freezes, canceled internships, and postponed projects are signs of trouble brewing. When major tech firms tighten belts, it’s often a bellwether for wider economic pain ahead.

8. Retail Stores Quietly Reduce Hours

While big headlines focus on mass layoffs or bankruptcies, a subtler retail trend often hints at recession first: reduced hours. You may notice your favorite local shop now opens later or closes earlier. Staff may be fewer, shelves might not be fully stocked, or there’s no one available to help. Retailers are among the first to react to slowing sales. Adjusting schedules and cutting employee shifts allows them to save costs quietly. When this starts happening across multiple locations and regions, it’s a strong clue that consumer spending is drying up.

9. Housing Market Slows Down

Few industries are as closely tied to economic health as real estate. When people feel good about the economy, they buy homes, take out mortgages, and invest in upgrades. But when uncertainty rises, so does caution. Suddenly, fewer buyers show up, listings sit longer, and price growth stalls—or reverses. Mortgage application rates, new home construction, and realtor earnings are early indicators to watch. Builders may cancel planned developments, while banks tighten lending. These shifts usually begin months before a full-blown recession hits. If the housing market slows, it’s wise to pay attention.

10. Consumer Sentiment Starts Falling

Consumer sentiment is the emotional pulse of the economy. It measures how people feel about their finances, job security, and the economy at large. While it may sound abstract, it’s often one of the most accurate predictors of future behavior. When sentiment drops, people pull back on spending. They save more, delay purchases, and become cautious. That caution translates to lower business revenue, slower growth, and eventually layoffs. The data doesn’t lie: declining consumer confidence has preceded nearly every U.S. recession in the last 50 years.

Final Thought

Recessions don’t always start with loud crashes—they often begin with whispers. By paying attention to small but telling economic changes like falling used car prices, rising credit card debt, and slowing freight traffic, you can spot the signs early. These shifts reflect real-world behaviors long before official numbers confirm a downturn. Staying alert to these subtle clues could give you the edge to prepare wisely, whether you’re managing a household, a business, or just your peace of mind.

Read More: America’s Most Depressed State Will Shock You (Don’t Move There)