We often assume wealthy individuals spend extravagantly on everything they desire, but the truth is that many rich people are selective about their purchases. They avoid certain expenses that may seem normal to others and instead prioritize investments that support long-term wealth, comfort, and growth. While not every wealthy person follows the same habits, there are common patterns that reveal how financial success shapes buying decisions. Let’s explore five things rich people tend to avoid and five they stock up on instead.

1. Flashy Logo-Centric Luxury Items

Credit: Pexels

Contrary to popular belief, many wealthy people are not interested in flaunting their wealth with obvious logos or heavily branded items. While someone with new money might splurge on designer handbags or clothing with large brand insignias, long-term wealthy individuals often avoid them. These items quickly depreciate in value and provide no real return. Instead of being a display of status, logo-heavy goods can attract unwanted attention and even reduce personal security by making someone an obvious target for theft.

2. Cheaply Made Trendy Products

Credit: Pexels

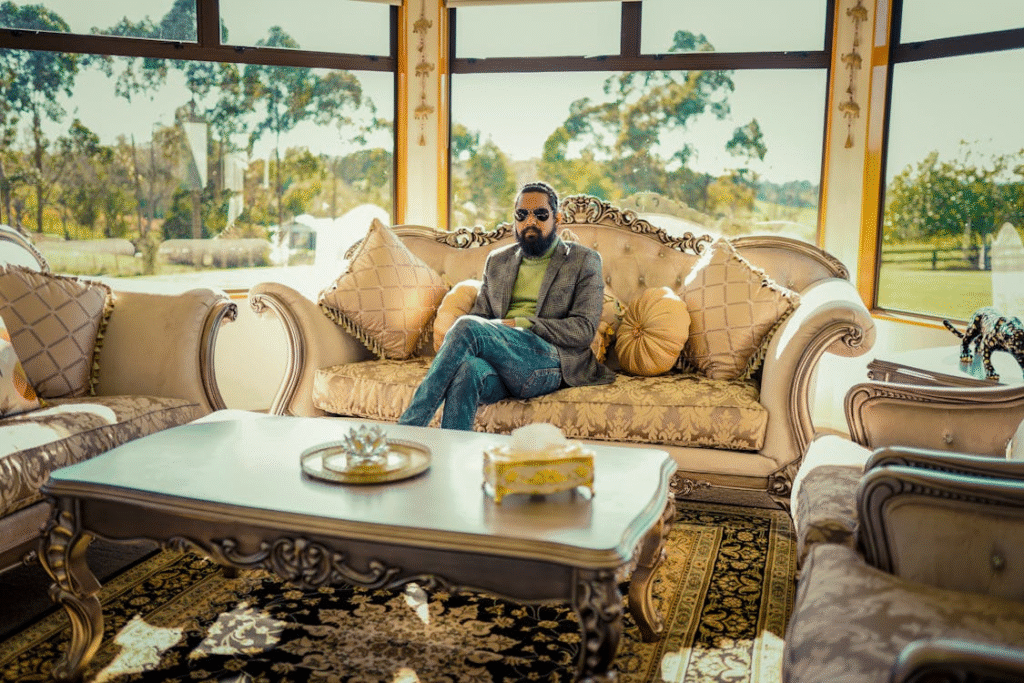

Wealthy individuals understand the difference between cost and value. They avoid buying low-quality products that are designed to be replaced quickly. For example, inexpensive furniture that falls apart within a year or fast fashion that wears out after a few washes is not attractive to them. Rather than wasting money on repeated purchases, they prefer durable goods that last for years. This perspective allows them to spend more upfront but save money and hassle in the long run.

3. Lottery Tickets and Get-Rich-Quick Schemes

Credit: Pexels

Rich people rarely spend their money on lottery tickets or quick investment schemes that promise overnight wealth. The odds of winning the lottery are minuscule, and wealthy individuals know that their money can be better utilized in proven investments. Instead of chasing luck, they rely on diversified portfolios, real estate, or businesses that provide predictable and sustainable returns. They value financial discipline and reject the idea of gambling as a wealth-building tool.

4. High-Interest Consumer Debt Purchases

Credit: Pexels

Wealthy individuals avoid putting purchases on high-interest credit cards or taking out predatory loans. They understand that consumer debt quickly erodes wealth. If they do use credit cards, it is often to benefit from rewards programs, with balances paid in full each month to avoid interest charges. They also avoid financing depreciating assets like cars with unfavorable terms. This practice keeps their cash flow strong and prevents money from being wasted on unnecessary interest.

5. Excessive Subscriptions and Disposable Upgrades

Credit: Pexels

Subscription fatigue is common among middle-income households, with many people paying for multiple streaming services, apps, and memberships they barely use. Wealthy individuals tend to monitor recurring expenses closely and avoid stacking unnecessary subscriptions. They also shy away from upgrading gadgets constantly just because a new version is released. Instead of being driven by consumer trends, they prefer to spend on items that offer meaningful improvements or long-term utility. Here’s 5 Things Rich People Stock Up On Instead:

1. Real Estate and Property Investments

Credit: Pexels

One of the most common things rich people accumulate is real estate. Property not only provides a tangible asset but also generates long-term value through appreciation and rental income. Wealthy individuals understand that land and property are limited resources, and over time they tend to increase in value. From vacation homes to commercial properties, real estate is a cornerstone of wealth preservation and growth.

2. Quality Timepieces and Jewelry as Assets

Credit: Pexels

While they may avoid logo-driven fashion, many wealthy individuals purchase high-quality watches and fine jewelry that retain or even grow in value. Unlike trendy accessories, luxury timepieces from reputable brands such as Rolex or Patek Philippe are considered investments. These items can be passed down through generations and often appreciate due to scarcity, craftsmanship, and brand legacy. For the wealthy, jewelry and watches serve both as functional items and as portable stores of value.

3. Experiences Over Possessions

Credit: Pexels

Rather than filling their homes with clutter, many rich people stock up on experiences such as travel, cultural events, or unique adventures. Experiences provide long-lasting memories and personal fulfillment, which studies show can bring more happiness than material goods. Exclusive trips, educational retreats, and curated dining experiences are often seen as more valuable than the latest gadget. Wealthy individuals understand that experiences enrich their lives in ways that possessions cannot.

4. Health and Wellness Resources

Credit: Pexels

Health is often considered the ultimate wealth. Rich people prioritize spending on high-quality food, fitness programs, preventative healthcare, and wellness routines. They stock up on organic produce, supplements, personal trainers, and medical checkups because they know that maintaining good health allows them to enjoy their wealth longer. Unlike fleeting luxury items, investments in health provide both immediate and long-term returns by improving quality of life and longevity.

5. Knowledge and Education

Credit: Pexels

Wealthy individuals continually invest in knowledge and skills, whether through books, courses, seminars, or mentoring. Education is a resource that compounds over time and cannot be taken away. Many stock up on financial education, professional development, and even specialized training to stay ahead in their industries. They view learning as a lifelong pursuit and recognize that personal growth directly impacts financial success.

The Mindset Behind These Choices

Credit: Pexels

The differences between what rich people avoid and what they accumulate stem from mindset. Those who build and maintain wealth focus on value, sustainability, and growth rather than short-term gratification. They avoid expenses that drain resources without return and instead prioritize purchases that generate income, security, health, or knowledge.

For many wealthy individuals, financial freedom is not just about having money to spend but about using resources wisely to create more opportunities. This mindset helps them preserve wealth across generations while enjoying a lifestyle that balances comfort, purpose, and security.

Managing Your Wealth

Credit: Pexels

The financial habits of the wealthy reveal that success is often about discipline rather than extravagance. By avoiding flashy, wasteful purchases and focusing on assets, experiences, health, and education, rich people create a foundation for long-lasting prosperity. These habits can serve as inspiration for anyone aiming to build a more secure financial future. Adopting similar strategies does not require immense wealth at the start, but rather a shift in priorities toward value-driven spending.

Read More: Little-Known Money Rules That the Wealthy Don’t Want You to Know

Disclaimer: This article was created with AI assistance and edited by a human for accuracy and clarity.